- 05 May 2023

- Public Relations

How to Get Over Your Forosophobia: 4 Tax Tips for Small Business Owners

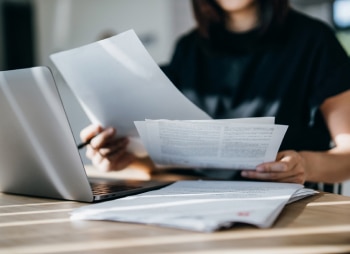

It’s that dreadful time of year again. You know, that time when you scrounge every nook and cranny for last year’s receipts, income statements and everything in between. That’s right, it’s tax season.

And that awful yearly feeling you get could be forosophobia, the fear of taxes and the IRS. It might sound like an irrational fear, but having to pay taxes can definitely trigger some IRS aversion or even feelings of low confidence.

That is why we created this handy list of tips and tricks to help small business owners get in the right mindset to conquer their tax anxiety and have a successful season. With that, here are 4 tips to help you get over your forosophobia.

Stay Organized

Owning a business is not easy. You have a lot to handle between clients, employees, services and products, and it’s understandable why you might feel overwhelmed by the additional burden of filing tax returns. So, it’s important to stay organized to ensure you can easily retrieve your records for easy filing.

Keep Accurate Records

One way to help your small business get ready to file is by keeping accurate records.

You can choose any recordkeeping system that best suits your business and clearly shows its income and expenses. It’s also very important to note that the type of business you have can affect the type of records you need to keep for federal tax purposes.

Your recordkeeping system should include a summary of your business transactions that includes gross income, deductions and credits. For many small businesses, their bank account will be the main source for entries in their accounting journals.

Use Accounting Software

You can choose from a wide variety of recordkeeping systems or methods that suit your small business needs.

One of the easiest, most common ways to keep records is through accounting software, such as NetSuite, ZohoBooks and Quickbooks.

Not only can software keep track of accounts receivable and accounts payable, but some also have the ability to track your overall profitability.

However, much like taxes, not all accounting software is created equal. That is why it’s important for you to understand which one will work best for your business.

Don’t Put Off Changes or Requests

Another important step in conquering your forosophobia is recording any changes that occur as they happen.

For example, say your small business experiences big changes involving your staffing or new additions to your operations: these things should be documented as they happen. This will ensure your records are always up to date and make it easier for you to recall any big changes come filing time.

Don’t wait until business is a little slow to catch up. For many owners, that time never comes, and you’re left spending too much time looking for the documents you need in order to file your taxes.

Ask for Help

Fear of asking for help meets the fear of taxes and the IRS. We understand. Sometimes it’s tough to ask for help even when you know you need it.

But when it comes to your taxes, you need the knowledge and experience to help your business. Fortunately, there are a number of resources available to ensure you have the support you need to overcome tax trepidation.

Tax Experts

You can spend long, excruciating hours sifting through documents to accurately represent your business happenings in the last year. Or you can pay a professional tax preparer to manage your business filing to ensure it is up to date on the tax code, so you get all of the deductions and credits you are eligible to receive.

If that doesn’t ease your forosophobia, experts can also help their clients:

- Answer questions and resolve issues.

- Avoid very costly mistakes.

- Review previous returns.

- Minimize their risk of an audit.

- Reduce the amount of taxes they owe.

- Provide sufficient anecdotal evidence.

Other Business Owners

Another great resource for overcoming negative feelings brought on by forosophobia is reaching out to fellow business owners. They are likely in the same boat as you and have in some way or another overcome their fear of taxes.

Maybe they have a great recordkeeping system that helps them come out on top. They might even have a recommendation for a licensed professional who’s been able to help them understand their situation better to get the most out of their tax returns.

Invest Your Time in Learning Tax Protocol

While you may not be a licensed professional or work for the IRS, it’s still good for small business owners to get a basic understanding of tax protocol.

Not only could this help reduce the amount of taxes you owe, it might also help alleviate extreme anxiety during this high-stress season. Not to mention that learning something you’re unfamiliar with is a great way to develop confidence in what you do.

Learn Tax Lingo

One way to build your confidence and overcome your fear of the season is to understand common lingo. There are quite a lot of words and phrases, but to get you started, here are a few:

- Allowance: Deduction or exemptions generally made in computing income, inheritance, gift and some forms of sales taxes.

- Audit: Verification and examination by an outside agency of a taxpayer’s books and accounts to ensure the accuracy of returns and declarations.

- Capital Tax: Based on capital holdings, as opposed to a capital gains tax.

- Deduction: Denotes an item that is subtracted from your taxable income.

- Depreciation: A planned, gradual reduction in the recorded value of an asset over its useful life by charging it to expense.

- Earned Income: Money brought in that is derived from personal services involving one’s employment, trade, business, profession or vocation.

That is just a small sample of what is out there. We highly recommend you read up on more words and definitions so you can better understand what is being asked of you.

Stay Up to Date on Tax Changes

The federal tax code changes almost every year, and your state’s tax code may change, too. This can affect anything from deductions and expenses to rates and more. It’s easy to see why so many people have a fear of filing taxes when there are so many updates to the codes.

As mentioned, that is why having an expert preparer working for you can help alleviate some of the fear involved in filing. However, if you do wish to stay on top of it yourself, the IRS has created a Small Business Tax Guide to help. Here the IRS has listed future developments to look out for and can answer any questions you may have about filing for your business.

Start Early

When we’re afraid of something, we tend to put it off as long as possible. The earlier you start preparing to file the better. As a small business owner, you should be proactive in documenting anything relating to your business expenses.

While keeping your records up to date is a lot of work, preparing them at the last minute will only stress you out more and create a greater fear of taxes and the IRS. We love working with small businesses to send their taxes early because we know how much of a relief it is for it to finally be over.

It’s okay to have a fear of filing and the IRS. The stressful situation warrants such a response. But know that you are in control of what you do with your business and there are ways to have a great tax season and overcome forosophobia.

You just need to put in the work and be confident in yourself and your business.

Remember, from printing and shipping to shredding and copying services, we’re here to help as much as we can.